PRODUCTS AND BENEFITS THAT AN INSURANCE SOFTWARE DEVELOPMENT COMPANY OFFERS ARE AVAILABLE

Every insurance company, agency, or brokerage firm deals with challenging tasks. For example, you must continually process claims, orchestrate, and renew customer policies. You must also manage groups, vendors, and customers. As a result, your day-to-day operations have far too many arms and complications. That is why you must capitalize on the technological advantage of an insurance software development company. It will be easier to meet customer expectations if you digitize your interactions with customers and vendors.

1. THE DEFINITION OF AN INSURANCE SOFTWARE

Numerous tools are available in insurance management software to help you run your daily business. Fundamentally, it streamlines operations for brokers, agents, agencies, and carriers while saving time and money. It should, however, assist both the client and administrative sides.

Figure 1. Insurance software is a technological necessity for the modern insurer

Underwriting, issuing policies, leading teams, monitoring claims, adhering to rules, and updating policy data are all included on the administrative side.

In contrast, the client side allows your customers to log in and perform simple tasks such as checking their policy, and eligibility, applying for insurance, filling out forms, making payments online, and more.

2. ALL THE COMMON TYPES OF INSURANCE SOFTWARE

2.1. DOCUMENT MANAGEMENT SOFTWARE

Document management software is required by insurance companies to securely store, organize, and access critical documents such as policy applications, customer proofs, contracts, policyholder agreements, and so on.

Figure 2. Some basic functions of a document management software system

However, insurers do not need a separate document management system as a type of software because their insurance software development company CRM, ERP, or other internal systems already provide this functionality.

2.2. INSURANCE LEAD MANAGEMENT SOFTWARE/CUSTOMER RELATIONSHIP MANAGEMENT SOFTWARE

CRM software for insurance companies has evolved to be the most practical solution for insurance processes. It integrates teams, distribution channels, call centers, agents, and field sales into a centralized portal. It has become a key enabler of the digital transformation of insurers, in addition to managing customer relationships.

CRM is a step ahead of the insurance lead management system in terms of lead management. To improve operational efficiency, it allows you to manage all of your products, teams, intermediaries, and channels. It aids in the digitization of insurance processes, from verification to new policy sales, renewals, upsells/cross-sell, and field operations.

2.3. SOFTWARE FOR INSURANCE WORKFLOW AUTOMATION

Workflow automation is the use of software systems to organize, monitor, control, and coordinate various business processes involving human resources, sales and marketing, lead management, and other functions.

STP (Straight-through Processing) or digital sales are two examples of workflow automation in insurance. The entire insurance process is automated in this case, from lead generation and online application to verification and policy issuance.

Insurance processes are typically complex and involve numerous touchpoints. That is why insurance companies use the automation of an insurance software development company to improve process efficiency and team productivity in their sales, call centers, and applications. Some CRM suites, such as LeadSquared Insurance CRM, include a workflow automation feature.

2.4. POLICY ADMINISTRATION SOFTWARE

Insurers use policy management software to create, administer, and manage insurance policies. Some software supports facultative agreements and reinsurance contracts. You can reduce insuring risks and handle reinsurance processes more efficiently this way.

2.5. SOFTWARE FOR UNDERWRITING

Underwriting is the most important aspect of the insurance industry because it assesses the risk of the company insuring a home, car, or an individual’s health or life. Underwriting software is used to manage the underwriting process for insurance companies. This function of an insurance software development company enables users to create rules and policies that will be executed automatically during the underwriting process, saving time and reducing human error.

Enterprise Risk Management (ERM) solutions are also used by insurers to digitize their risk assessment process.

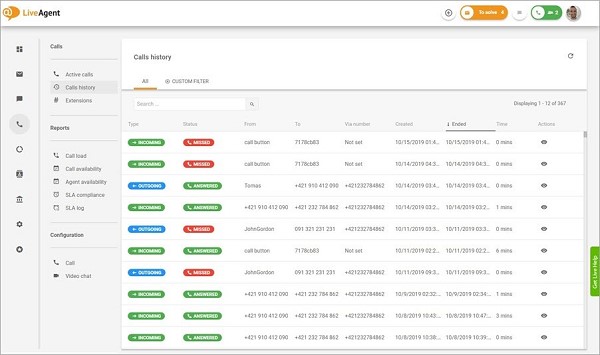

2.6. CALL CENTER MANAGEMENT SOFTWARE

It enables sales representatives and calls center agents to communicate with existing and prospective customers via voice, web, chat, or email.

Figure 3. Call center management software helps your business have more insight into your customer

Insurance companies now integrate their CRM software with cloud calling, VoIP, or telephony systems rather than deploying separate software. This insurance software development company solution enables reps to call customers directly from the portal, eliminating the need for manual dialing and updating records.

2.7. SOLUTIONS FOR VIDEO KYC/KYC

Since the Covid-19 pandemic, insurance regulatory authorities in some countries have permitted video-based KYC (know your customer) for customer onboarding. It supports video recording and screenshots, real-time verification, geolocation capture, and image verification (matching customer photograph with ID photograph).

Because there are so many variables in the insurance industry, such as national regulations, policy preferences, customer demographics, and so on, insurers have long preferred in-house software solutions. However, cloud computing and SaaS (Software as a Service) is gaining popularity. By a report from an insurance software development company, in 2020, 84% of all insurance core system purchasing transactions would be cloud-based. The ability to customize a SaaS solution to meet the needs of an organization is making things even easier.

2.8. INSURANCE ANALYTICS SOFTWARE

Insurance analytics software is used to examine the vast volumes of data that insurance firms deal with on a regular basis. Making better judgments regarding underwriting, claims, and pricing can be aided by its ability to see patterns, evaluate risks, and detect trends.

Software for insurance analytics can offer insights into consumer behavior, market trends, and competitive dynamics. This data may be utilized to create new goods, enhance current ones, and improve pricing tactics.

2.9. CLAIMS MANAGEMENT SOFTWARE

The claims process is managed by claims management software, from the first claim registration through the claim settlement. By delivering real-time status updates and alerts, it aids insurers in streamlining their claims handling procedure and enhancing customer service.

It takes less time and effort to handle claims when operations like claim registration, adjudication, and payment processing are automated using claims management software. In order to offer a comprehensive perspective of the claims process, it can also link with other systems, like as document management and underwriting software.

2.10. INSURANCE ACCOUNTING SOFTWARE

The financial parts of an insurance company, including accounts receivable, accounts payable, billing, and financial reporting, are managed using insurance accounting software. By offering real-time financial data and insights into important performance metrics, it may assist insurers in enhancing their financial performance.

The time and effort needed to handle financial operations may be decreased by using insurance accounting software to automate functions like billing, payment processing, and financial reporting. In order to give a holistic picture of the business, it can also link with other systems, including underwriting and claims management software.

2.11. INSURANCE ERP SOFTWARE

Accounting, finance, human resources, and customer relationship management are just a few of the company operations that are integrated into a single system by enterprise resource planning (ERP) software, a comprehensive business management solution. Specifically created for insurance firms, insurance ERP software may help insurers increase operational effectiveness, save costs, and improve customer experience.

In order to run insurance operations more efficiently, insurance ERP software may automate processes including policy administration, underwriting, claims management, and financial reporting. In order to assist insurers make better decisions, it may also offer real-time data and insights into critical performance metrics.

3. BENEFITS THAT AN INSURANCE SOFTWARE DEVELOPMENT COMPANY CAN OFFER

Insurance operations are complex and involve numerous stakeholders (for example, consultants, agents, and third-party agencies). Traditional processes were riddled with redundancies and dependencies, resulting in interminable delays. Fortunately, modern software solutions efficiently overcome these obstacles and provide customers with a better insurance experience. The following are some of the remarkable advantages.

3.1. INCREASE YOUR EFFICIENCY AND PRODUCTIVITY

Your insurance software development company is already aware of the information storage format. It also enables you to search for your data in a single database. It makes it simple for you and your agents to achieve your objectives while saving you a lot of time and money.

3.2. IMPROVE CLIENT COMMUNICATION

It assists your agents/sales reps in developing positive client relationships. Clients and agents can view form status, memos, and deadlines in real-time. It also reduces the likelihood of serious errors and miscommunication.

3.3. HELP TO REDUCE THE TOTAL COST

An insurance software development company helps your employees work more efficiently by streamlining processing operations. It also implies that manual errors can be reduced and eliminated. Such errors usually necessitate twice as much time to correct. As a result, you can reduce the extra hours of operation and, the cost of operation.

3.4. IMPROVE YOUR INTERACTIONS WITH AGENTS AND CARRIERS

Real-time policy information is available through software solutions. It will be useful to agents and brokers who work with a variety of insurance companies and policies. The insurance software development company can allow them to compare rates and policies as quickly as possible. As a result, they can meet customer demands in record time.

3.5. MANAGEMENT OF COMPLIANCE

Insurance software development company product makes it simple to implement a built-in compliance protocol. It assists your insurance company in staying on top of ever-changing regulations. You don’t have to worry about costly mistakes or wasting time manually changing directives. The insurance system will ensure that each case moves at the appropriate rate. It can also automatically highlight areas that need your attention.

Figure 4. Management of compliance help all your employee stay on track with what your business values

3.6. HELP TO IMPROVE YOUR CUSTOMER SERVICE

Your insurance software development company enables you to communicate with your clients quickly. It makes assessing their situations and providing appropriate quotes easier. It also ensures that your customers can complete service requests when it is convenient for them. Insurance CRM software with opportunity management capabilities takes this a step further. It sends upsell and cross-sell signals to sales reps and agents by understanding customer activities on your website, ads, or marketplaces. As a result, more deals are being closed and more revenue is being generated.

3.7. ENHANCED DATA SECURITY

Choosing automation over paper and spreadsheets greatly improves data security. The majority of insurance software solutions also include user authentication and encryption protocols.

3.8. EASIER TO GENERATE ANALYTICS AND REPORTS

Data is essential for staying informed about your insurance company’s performance. Typically, businesses do not deploy a separate analytics and reporting system. CRM/ERP systems include analytics. They generate routine statistical reports. You can even export this information for further analysis.

3.9. MORE ACCURATE, FEWER MISTAKE

Your insurance software development company should include tools for validating data accuracy. QA systems, audit systems, payment verification systems, address converters, and so on are examples.

When the system generates policy and document schedules automatically, errors are reduced even further.

Aside from these, there are dedicated insurance software solutions to assist in the detection of fraudulent claims and speed up the investigation processes. Insurers are also incorporating Artificial Intelligence (AI) and RPA (Robotic Process Automation) into their operations. AI-powered chatbots are a simple example of this.

3.10. INCORPORATING EMERGING TECHNOLOGIES

Insurance businesses are progressively integrating AI and RPA into their operations, as was previously noted. One example of how these technologies are being utilized to enhance customer service is chatbots that are driven by AI. Another illustration is the use of blockchain technology for managing policies and processing claims. These procedures are made more secure, transparent, and immutable thanks to blockchain technology, which lowers the possibility of fraud and mistakes. Machine learning algorithms may also be utilized to assess client data and offer individualized pricing and policy suggestions.

Overall, partnering with a firm that develops insurance software may have a number of advantages, such as higher productivity, better customer communication, lower costs, improved data protection, and simpler access to analytics and reports. Insurance firms may streamline their processes, remain ahead of the curve, and offer better client experiences by adopting innovative technology.

SUMMARY

Insurance software development company is no longer just a means of survival in this cutthroat industry. It is now necessary to gain and keep a competitive advantage in the insurance market. Digital insurance solutions are also extremely beneficial because they enable you to empower all of your teams and effectively meet customer demands. The right solutions can improve efficiency, safety, and profitability for any insurance agency, brokerage, or carrier.

Source: Internet

——————————

L4 STUDIO – LEADING SOFTWARE DEVELOPMENT COMPANY IN VIETNAM

Website: https://l4studio.net/

Email: hi@l4studio.net

Phone: (+84) 28 6675 6685

Our Mobile App Development Services: https://l4studio.net/mobile-app-development/

For more exciting blogs: https://l4studio.net/it-knowledge/

Follow us at: https://www.facebook.com/L4Studiovn/

Read more: