How is SAP helpful in Finance software outsourcing in Ho Chi Minh city?

We talk about what SAP is through this post and how SAP is beneficial in finance. Let’s scan all around this article to get more information involved in SAP and its application in finance software outsourcing in Ho Chi Minh city.

1. Overview of SAP

SAP (Systems Applications and products) is a commonly used enterprise resource planning software SAP makes a centralized system for organizations that stimulate each function to access and share popular data to make a great work environment for each staff across the corporation.

By enabling employees across all departments to access particular information, SAP software enables various firms to manage their processes, accelerating productivity and progress. Employees can devote more time to important work since they have access to information across departments.

Large organizations as well as small businesses of all sizes can profit from SAP software. The application incorporates all obtained information and effectively and clearly displays it. While educating people on SAP software, make sure to do your research on the modules that best align with the objectives and long-term plans of your business.

Figure 1. SAP central finance

What is SAP used for in Finance software outsourcing in Ho Chi Minh city?

With each company function keeping its own operational data in a separate database, traditional business models frequently decentralized data management. Employees from various company departments find it challenging to access each other’s information as a result. Data duplication across several departments also raises the cost of IT storage and the chance of data inaccuracies.

SAP software offers numerous business operations with a single view of the truth by centralizing data management. By providing employees from many departments with simple access to real-time data throughout the whole firm, this aids businesses in better managing complicated business processes. As a consequence, companies may quicken workflows, boost productivity, increase operational effectiveness, improve customer experiences, and ultimately boost revenues.

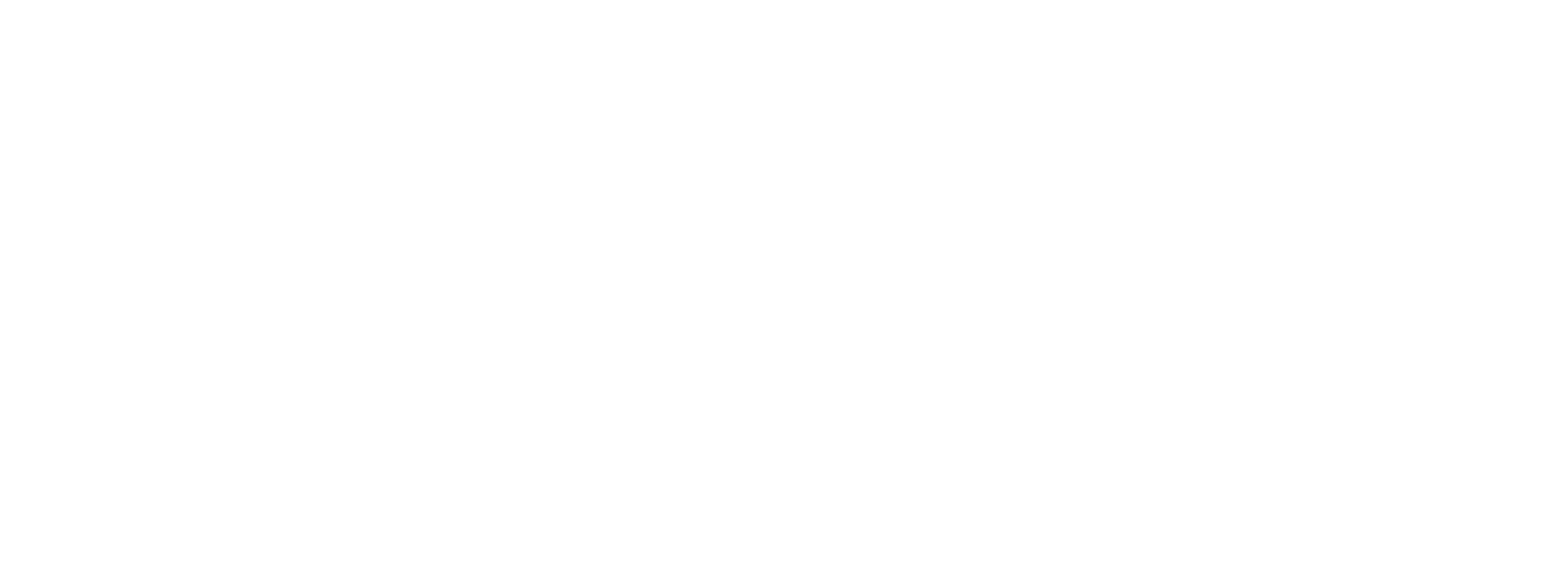

3. What SAP module is suitable for use in Finance software outsourcing in Ho Chi Minh city?

A lot of accounting tasks are keeping ledger balance sheets. Our answer is the SAP FI module. The SAP FI module is the most commonly used module for accounting and financials. The profits and loss statements are controlled easily by SAP ERP solutions.

Figure 2. SAP-FICO

There are sub-modules in SAP FI that finance software outsourcing in Ho Chi Minh city to help you improve its functionality and usability. Which are:

3.1 New General Ledger in SAP FI (New GL)

Several ledgers no longer need to be kept up with thanks to the SAP New General Ledger. As a single program, its functionality fully covers both administrative and financial accounting.

Through real-time, rules-based allocations between business units, New G/L enhances financial accounting and reporting. Moreover, it automates the tying together of journal entries from several components.

In contrast, typical (classic) GL systems call for numerous applications to be reconciled in order to fulfill enterprise-wide reporting needs.

The versatility offered by New G/L allows you to design several ledgers, including:

- Price of the sales ledger

- A staging-consolidation ledger

- Division ledgers

- Also, profit center accounting

3.2 Accounts Payable (SAP FI-AP).

Accounting information for each of your vendors is entered into and managed by SAP Accounts Payable. The buying system includes SAP FI-AP, which automatically posts transactions in response to operational activities.

Moreover, it provides invoice data to the Cash management application component to enhance liquidity planning.

With SAP FI, you may pay your payables using a built-in payment mechanism. Depending on the transaction, the posts made in FI-AP are simultaneously recorded in a number of G/L accounts.

3.3 Accounts Receivable (SAP FI-AR)

Like FI-AP, FI-AR maintains and records accounting information for each of your clients. It is crucial to effective sales management. Every posting in FI-AR is also directly logged in the GL.

You can track open items using a number of tools in SAP Accounts Receivables. by reminding your clients of their outstanding debts with the use of a dunning campaign.

Also, this tool offers the information you want for efficient credit management and liquidity planning. This is due to the linkages it gives to cash management.

3.4 Asset Accounting in SAP FI (FI-AA)

The SAP Finance system is used to handle the fixed assets of your business. It uses a subsidiary ledger to the G/L called FI-AA (Asset Accounting in SAP FI). Regardless of the type of industry, you may utilize this everywhere.

It is also connected with other application domains.

Data is also sent to and from other SAP components through FI-AA. Depreciation and interest can therefore be transferred straight to the FI and CO components.

3.5 Bank Accounting in SAP FI (FI-BL)

Together with handling incoming and outgoing payments, FI-BL (Bank Accounting in SAP FI) also allows for the management of cash balances and Bank Master data. You may flexibly specify all nation-specific attributes with this. They consist of:

- The requirements for manual and electronic payment methods

- Payroll paperwork, etc.

4. The role of SAP in Finance control and accounting

SAP offers a suite of accounting and financial control systems that provide corporations tools they want to monitor their finances. Here are some of the financial control systems, such as

4.1 Accounts payable and receivable

This system offers more modules that support credit assessment, potential risk control, dispute control, and invoice control.

4.2 Accounting and tax control

This system supports financial accounting, reporting, regulation compliance, and closing process accounting specialists.

4.3 Treasury and cash control

This system consists of cash control, debt control, risk control, and investment management attributes.

4.4 Financial planning and analysis

This system supports finance specialists with forecasting, budgeting, efficiency management, analytics, and reporting.

Figure 3. The development platform of SAP financial accounting and controlling

5. Is SAP good for Finance?

SAP FI can stand for Financial accounting, and it is among the crucial modules of SAP ERP. It is used for storing the financial data in the group. In addition to that, SAP FI can make you analyze the financial circumstances of the plant on the market.

5.1 EFFICIENCY OF BUSINESS

The ERP system will eliminate repetitive chores and free up the employee’s time so they can concentrate and give their full attention to more crucial responsibilities. It completes routine processes with accuracy and efficiency, improving the business’s day-to-day operations and drastically lowering expenses and mistakes.

5.2 DATA PROTECTION

As technology advances and cyber security breaches and hacks rise drastically, data security is becoming a rising problem in modern companies. Because of this, the SAP ERP system is designed to increase data security by limiting access to pertinent data through integrated security systems and firewalls. On the other hand, data is regularly backed up and centrally located to avoid any malfunction that might result in information loss.

5.3 SCALABILITY

The ability to scale is a key feature that enables users to modify their data processing setup as their business grows and shrinks. The SAP software makes the shift easier, ensuring that businesses have the flexibility they want, whether they are venturing into new market fields or just growing their client base. With SAP’s assistance, users may easily scale up a basic integration to meet their industry’s requirements.

5.4 LOWER COSTS

As often demonstrated. Due to its qualities of automation, centralization, and reduction of administration and operating costs, SAP ERP may significantly reduce costs for the organization. Businesses may work more skillfully when repeated operations are delegated to a SAP system since there are fewer issues that might occur.

5.5 ENHANCING DATA MANAGEMENT

As Data Management is the main factor that influences whether or not firms install SAP, it more than lives up to expectations. SAP ERP solutions bring together and keep all of a company’s dispersed data in one place. As a result, data is simple to access and can be rapidly reviewed. Moreover, ERP employs a level of automation that allows employees across the board to examine common data without maintaining manual records.

5.6 CONSUMER ASSISTANCE

It can be difficult to maintain customer happiness while controlling sales and inventory, especially if customer and inventory data are kept on different platforms. Your customer information is organized and streamlined when ERP systems are implemented, offering your sales representatives a solid foundation to establish long-lasting client connections. Also, it gives a faster traceable feature.

5.7 ANALYSIS AND PROGNOSTICATION

For staff, producing accurate analysis and reporting may be a taxing undertaking. Information risk is avoided by using a SAP ERP system since there is no data duplication. The technology offers immediate information on each work being performed inside an organization. Moreover, it provides risk analysis with precise performance results.

Bottom lines

That’s all about the SAP financial and accounting. This post covers necessary information related to the benefits of SAP in finance. Please return your feedback to us as soon as possible. Thank you!

Sources: Internet

——————————

L4 STUDIO – LEADING SOFTWARE DEVELOPMENT COMPANY IN VIETNAM

Website: https://l4studio.net/

Email: hi@l4studio.net

Phone: (+84) 28 6675 6685

Our Digital Transformation Services: https://l4studio.net/digital-transformation-services/

For more interesting blogs: https://l4studio.net/it-knowledge/

Follow us at: https://www.facebook.com/L4Studiovn/

Read more: WHAT IS THE FUNCTION OF MOBILE BANKING SOLUTION PROVIDERS?