How Do E-Wallet Apps Work And How Can Benefit Users?

E-wallets, commonly referred to as digital wallets, are a vital component of contemporary technology. Many consumers choose to make purchases using e-wallet apps rather than alternative payment options. So what are the main reasons why this type of payment app can improve the payment experience of your user?

1) Security

E-wallet apps are one of the finest solutions now available for protecting your information, even if it can be difficult to determine which tech tools are truly secure to use. If your wallet is stolen, all of your cash and credit cards are lost instantly. However, since payment applications are built on encryption technologies, your data is safe and less likely to be compromised. In reality, when you make a purchase using a digital wallet, a token that is valid just at that retailer for that transaction is used instead of your actual card number. That guarantees that your personal data won’t be taken in the event of a cyberattack on a business or store.

Figure 1. Security is the most popular reason why people want to use e-wallet apps

2) It is much more convenient than many types of payment

While not all retailers allow online payments but the vast majority already do, and more intend to in the future. You are able to carry out transactions in a simpler, quicker, and more secure manner when you pay using your e-wallet apps.

3) Reducing stress when shopping

Say goodbye to laborious checkout forms when you purchase online or rummage through your handbag in the drive-through for a stray debit card. Your e-wallet apps will streamline and simplify your transactions.

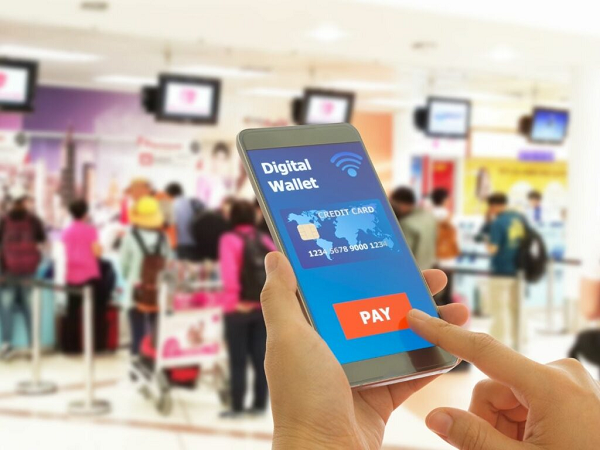

4) Many e-wallet apps are free to use

You won’t pay anything to move from real cards and cash! The majority of transactions made with your e-wallet are free of charge.

Figure 2. Many e-wallet application providers don’t apply charges to their user

How do e-wallet apps work?

E-wallet apps function just like real wallets and may save information from credit cards, debit cards, loyalty cards, digital coupons, boarding tickets from airlines, and even driving licenses. Without having to keep track of several passwords, an E-Wallet may be used to make safe payments both online and in physical stores. While E-Wallets handle the transaction directly, digital wallets just store payment information and communicate with your bank account to complete transactions.

Types of e-wallet apps we commonly use

1. Closed wallet apps

Closed wallets, which can only be used to conduct transactions with the wallet’s issuer or other holders of the same wallet, are digital wallets developed by businesses that deal with goods or services. Ola Money and Amazon Pay are a few examples of closed wallets.

2. Half-close wallet apps

Semi-closed (half-closed) wallets are digital wallets that allow users to conduct online and offline payments at specified merchants and businesses. To accept payments from e-wallet apps, retailers must sign an onboarding agreement with the wallet’s provider. A semi-closed wallet is an example of a Paytm Wallet.

3. Open wallet apps

Open wallets are digital wallets that can only be issued by banks or institutions that have a partnership with a large bank. These wallets let users do the same operations as semi-closed wallets, but also allow them to withdraw money from ATMs.

Conclusion

E-commerce success is all about removing obstacles between the client and the sale. Even minor friction at the time of purchase might cost you sales. The simpler it is for customers to pay safely and easily like implementing e-wallet apps payment method, the lower your bounce rates and the danger of shopping cart abandonment.

Source: Internet

At L4 Studio, we strive to be a top Software Development Company in Southeast Asia, offering affordable, innovative solutions to help global businesses achieve their goals.